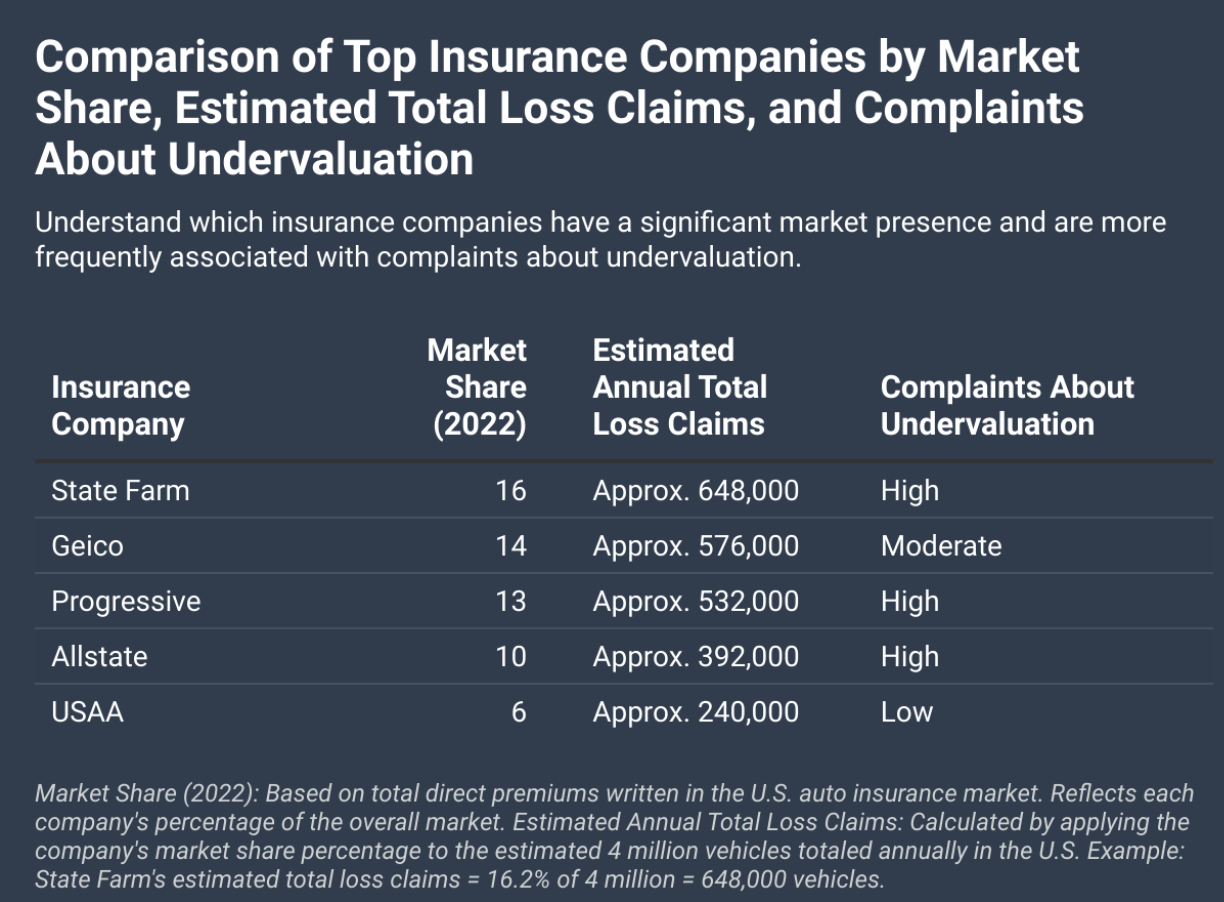

Each year in the U.S., millions of vehicles are declared total losses, with a rise in claims since 2020. Some insurers, like State Farm, Allstate, and Progressive, undervalue these claims by using outdated tools, ignoring upgrades, and offering low settlements. This has led to legal actions, including a class-action lawsuit against State Farm.

Policyholders can challenge unfair settlements by getting independent appraisals, seeking legal advice, and documenting their vehicle’s value. Regulatory bodies are calling for stricter standards to ensure fair compensation.

Discover more about the hidden cost of undervaluation in insurance settlements for totaled vehicles.

How Insurance Settlements Fall Short of True Value

Reviewing the data presented in LexisNexis® U.S. Auto Insurance Trends Report, we find that in 2023, more than 25% of collision claims were considered total losses. Since 2020, the number of total loss claims has increased by 29%.

Undervaluation in insurance settlements happens when an insurer offers less money than a vehicle is actually worth. Major insurers like State Farm, Allstate, and Progressive receive many complaints about undervaluing claims.

Insurance adjusters may use the following tactics to undervalue claims:

- Using outdated vehicle valuation tools

- Ignoring upgrades or modifications to the vehicle

- Relying on biased or incomplete market data

- Underestimating repair costs

- Offering lowball settlement offers

- Failing to consider the true market value of the vehicle

- Disregarding regional pricing differences

- Offering a settlement before full damage assessment is complete

Undervalued settlements can result in significant financial loss for policyholders, with some losing thousands of dollars. For example, if an insurer undervalues a totaled vehicle, you may not receive enough money to replace your car or cover repair costs, leading to financial hardship. This can make it harder for you to get back on the road and rebuild after an accident.

Legal Actions Against Insurance Companies

State Farm is facing a class–action lawsuit for undervaluing claims on totaled vehicles. The lawsuit alleges systematic undervaluation, potentially affecting thousands of policyholders.

In 2023, U.S. District Judge Virginia Kendall ruled that the case could proceed in federal court, denying State Farm’s request to dismiss it.

This lawsuit could have significant implications for both policyholders and the insurance industry. If successful, it may set a precedent for other insurers, encouraging fairer valuation practices across the industry.

Understanding Your Rights as a Policyholder

As a policyholder, you have the right to challenge an unfair settlement offer. If you disagree with the insurance company’s valuation, you can dispute the settlement. Knowing your rights helps ensure you receive fair compensation for your totaled vehicle.

Best practices to ensure a fair settlement:

- Keep records of vehicle enhancements and modifications.

- Research the fair market value of your vehicle.

- Question the insurance companies’ offers.

- Request a copy of the damage report from the insurance company.

- Seek an independent appraisal if you disagree with the insurance company’s valuation.

- Be aware of the current market trends and vehicle pricing.

- Document any repair estimates you receive from auto shops.

There are things you can do to protect the value of your claim. Stay informed about your rights and options to protect your interests and ensure you receive a fair payout.

The Importance of Regulatory Oversight

Regulatory agencies help ensure that insurance settlements are fair. They oversee the practices of insurance companies to make sure policyholders are treated justly. There is an increasing push for stricter rules and consistent methods to determine the value of vehicles.

These changes would make it harder for insurers to undervalue claims, protecting consumers by ensuring they receive the full compensation they deserve when their vehicle is totaled.

A Car Accident Lawyer Will Not Let Insurance Companies Devalue Your Claim

The insurance company knows that you are in a financially vulnerable position after a collision, and they will take advantage by paying you less than you deserve so they can make a profit.

An experienced Atlanta car accident lawyer will make sure insurance adjusters don’t undervalue your claim for a totaled vehicle. We will fight to get fair compensation for your car’s true value.